How much does it cost to open a coffee shop?

Coffee Shop Finances: Frequently Asked Questions

Aspiring entrepreneurs from all over the world come to our classes with a dream of opening a successful coffee shop. Often, they’ve funneled creative energy into envisioning the concept, the space, the menu, and the name. Now, there’s one major hurdle that seems to be the source of all their questions: money. What are some of the most common questions we hear about coffee shop finances?

What does it cost to open a coffee shop? Can it be profitable? Will I be able to make a living?

Most entrepreneurs would be much more comfortable getting started if they had *answers* about money instead of questions. That’s what we’re offering today. We’re sharing answers, tools, strategies, and best practices for coffee shop finances.

A note before we get started: We don’t claim to have a crystal ball for the financial stability of every coffee shop. However, we do have thoughtful, informed, time-tested financial strategies to offer coffee shop owners. The financial principles we teach in our coffee business classes have been carried out by many students who have opened successful coffee shops worldwide. The best way to walk through them in depth is to sign up for our 3-Day Coffee Business Master Class®.

How much does it cost to open a coffee shop?

Fully operating coffee shop start-up expenses will vary based on where you live and what type of business you’re opening. Here’s a ballpark estimate to consider for a fully operating start-up investment:

- Mobile Coffee Cart: $7,500 to $15,000

- Fixed Coffee Kiosk: $15,000 to $60,000

- Coffee Trailer: $15,000 to $55,000

- Coffee Truck: $35,000 to $100,000

- Parking Lot Drive-Thru or Stationary Trailer: $80,000 to $260,000 (not including land)

- Traditional Sit-Down 1,500 Sq/Ft Coffee Shop: $300,000 to $625,000

- Small Cafe Style Restaurant Coffee Shop Hybrid: $550,000 to $1M

- Adding A Coffee Bar To An Existing Retail Food/Beverage Business $6,000 to $45,000

How do I fund my cafe start-up?

Most of our students do not come to us with huge savings accounts and private investors. In fact, we realize that simply registering for our class is a major investment of both money and time for our Coffeepreneur® students. We truly believe that anyone can open a successful coffee shop if they’re resourceful, resilient, and patient enough to do it the right way. Here are a few of our tips on funding sources:

Saving:

We know this isn’t the most exciting way to talk about money, but entrepreneurship is a lifestyle. It requires consistency, intention, and discipline–and it doesn’t happen overnight. You have to start somewhere, and being intentional with how you spend is going to serve you well once you’re a business owner.

Grants:

There is A LOT of free money out there if you are willing to put in the effort to find it. Most people will be too lazy to put in the effort, so believe it or not, it can be a lot easier than you might suspect to secure. We like to start with the local Chamber of Commerce (try city, county, or state) and the SBA. There are often programs to help you start or grow a small business.

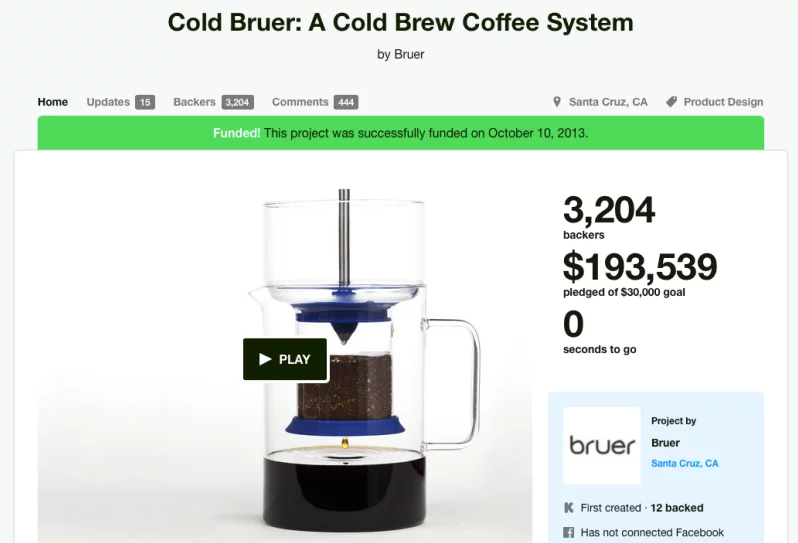

Crowdfunding:

Sites like gofundme.com and kickstarter.com have helped fund countless coffee shops and startups!

Private investment:

We actually don’t recommend bringing in investors to start your business, since it often requires giving away a percentage of your ownership. You have to think long-term. You might need that equity later–when it’s time to grow from one location to more. If you’ve already given away a big piece of your ownership, it’s harder to secure a strategic partner as you look to scale.

Partnerships:

We’ve helped many Coffeepreneurs® launch coffee shops with a partner or friend. The successful ones approach partnerships very cautiously and thoughtfully. First, bringing in a partner means giving away equity. Make sure that equity is going to a skill set that will help your company thrive and grow long term. Second, we sometimes say to avoid doing business with family or friends if you truly value them in your life. Business can change the dynamic of your relationship, not always for the better.

Is a coffee shop a profitable business?

It definitely can be! The best thing about entrepreneurship is that there’s no ceiling to how much you earn or grow. Not every coffee shop will be profitable, of course, but they’re much more likely to be if you’ve put together an intentional concept. Entrepreneurs need true understanding of the people they’re serving and how to offer them a unique experience. In addition, profitability will require a solid business plan and thoroughly vetted location. Finally, the financial principles we emphasize are for long term success, not overnight wealth. Anything that feels like a get rich quick scheme probably is.

How do I create a financial plan for my coffee shop?

Accumulate all of your business costs, including rent, insurance, equipment, soft goods, and buildout estimate. Put together a 5 Year Financial Plan spreadsheet to collectively take into account all your financial data points:

- Total start-up investment

- Budget

- Annual projected sales

- 5-year growth

- Return on investment timeline

Tip: be extremely conservative on your projected sales in your first year. More on that next.

How long does it take a coffee shop to break even?

There’s no hard and fast rule, but coffee shops generally have a challenging first year. We tell our students not to expect to break even or become profitable for about three to four years on the first location. The second and third locations tend to happen much faster once the brand is established, the once unknowns about your market have become more known.

What other financial considerations should I make when opening a coffee shop:

Your business and financial plan will revolve around some key factors: your menu, your location, your expenses, and your average coffee shop transaction. Here are a few more financial concepts to be extremely intentional about when opening:

Estimate the Earning Potential of a Location

One big mistake coffee shop owners make is choosing a location based on the way it looks rather than it’s true earning potential. Have you found a beautiful space with natural light and exposed beams? That’s great! But, if it’s in the wrong place or isn’t accessible to the customers you’re targeting, it won’t be profitable. You need to accurately calculate the volume drive-by traffic and walk-by traffic as they relate to your average coffee shop transaction rate. Then, that number needs to be weighed against expenses (like rent and other operating expenses) in order to get a real sense of a location’s earning potential.

Setting Effective Menu Pricing

Menu pricing should not be arbitrary. Every menu item needs to be priced based on what it costs you. Each menu item should cost you, the coffee shop owner, about 20 to 28% of what you charge the customer. To effectively price your menu, you need to be well acquainted with the cost of your ingredients. It’s important to know which ingredients fluctuate throughout the year (i.e. dairy and produce) to have an accurate estimation of your cost of goods.

Hiring and Staffing

Labor will be one of your biggest investments. That’s why it’s extremely important to hire and retain the right people. The coffee shop and restaurant industry has a high turnover rate. (And of course, hiring is especially difficult in 2021.) Have clear guidelines for hiring, training, and managing your coffee shop to ensure you’re investing in people who want to grow with you and add value to your business, rather than on costly employee turnover.

What financial principles and strategies do you teach in your coffee business classes?

We recommend our 3-Day Coffee Business Master Class® as the most comprehensive, up-to-date training in the industry. We cover everything we’ve talked about in this article in depth with very specific details, and more.

Our Business Class Financial Strategies and Tools:

- 5-Year Financial Plan Template

- How to Estimate the Earning Potential of the Location (including sample spreadsheets)

- Menu Costing Spreadsheet and Pricing Guidelines

- Coffee Shop Budget Guidelines

- Coffee Roaster and Vendor Guidelines (and contact information)

- Recommended Equipment and Supply Lists

In addition, our business class covers these coffee shop financial considerations:

- Lease Negotiation Tips

- Contractor and Build Out Tips (to stay on schedule and budget)

- Manager and Barista Training Guidelines (and sample Employee + Management Handbooks)

- Retail Sales (tips for increasing profitability)

- Inventory Tracking Resources

And, that’s just the financial content. Plus, work in a small class size with our coffee educators who can answer your personal financial questions. To see the full scope of the 3-Day Coffee Business Master Class® or to register, click here.

Register for a Coffee Class

The Best Coffee Training Available

We’ve helped hundreds of students successfully launch their own coffee shop businesses. Join us in our 5-Star Rated Coffee Classes, whether you’re an aspiring entrepreneur looking to open a coffee shop, a manager, a barista or home enthusiast looking to sharpen your skills.